dependent care fsa vs tax credit

The Pros and Cons of the Dependent Care FSA The Pros Saves You in Taxes You Can Stash a Good Chunk of Change Saves You More in Social Security and Medicare Taxes. Prior to the American Rescue Plan Act of 2021 the Dependent Care Tax Credit provided a maximum of 35 of eligible childcare expenses paid during the year as a tax credit.

How You Can Claim Up To 16k In Tax Credits For Child Care In 2021 What To Do First Mlive Com

5000 is the maximum whether for one child or.

. For the majority of individuals earned income is your annual wages minus any non-taxable items such as traditional employer retirement account contributions 401k 403b etc health care. Dependent Care FSA vs. You can set aside up to 5000 in pretax money in your FSA then claim the dependent-care credit for up.

Dependent Care FSA vs Dependent Care Tax Credit. The Dependent Care Tax Credit allowed taxpayers to claim up to 3000 of expenses for one dependent and up to 6000 in expenses for two or more dependents. Dependent Care FSA.

How it works on the IRS Form 2441 and how they save yo. Listed in the Tax and Credits section. The software will calculate these credits but the correct information must be.

Do you know about the changes to the Dependent. The 35 maximum credit applied to tax See more. Today we discuss how the Dependent care FSA affects the child and dependent care tax credit for 2022.

The annual maximum pre-tax contribution may not exceed 5000 per year regardless of number of children. The dependent-care tax credit can help if you dont have an FSA at work. Child and Dependent Care Credit chapter in Publication.

34572 AGI - 9350 standard deduction 25222 taxable income puts you in the 12 tax bracket With the dependent care FSA you can put away up to 5000 for daycare expenses. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. If your household income is below 169000.

A Dependent Daycare Flexible Spending Account and the Child Care Tax Credit can help reduce your financial burden and let you keep more of what you earn. The FSA saves you 20 state tax rate in taxes on 5k the credit returns 50 of expenses though expense amount is reduced by whatever you pay through the FSA. The maximum credit was 35 of eligible expenses resulting in a credit of 1050 and 2100 against total tax liability.

Unlike the dependent care FSA however. Dependent Care FSA vs Dependent Care Tax Credit. Tax Credit Both the dependent FSA and child and dependent care tax credit provide tax advantages but they calculate their respective tax.

If you pay 6000 - 11000 in childcare. I missed it when it was first announced but I just saw the changes to the dependent care FSA and dependent care tax credit and now Im not sure which would be better or if we can even change. If you pay more than 6000 in childcare costs dont use the dependent care FSA take the credit.

The child and dependent care tax credit covers similar expenses as the dependent care FSA. Child and dependent care tax credit.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Publication 503 2021 Child And Dependent Care Expenses Internal Revenue Service

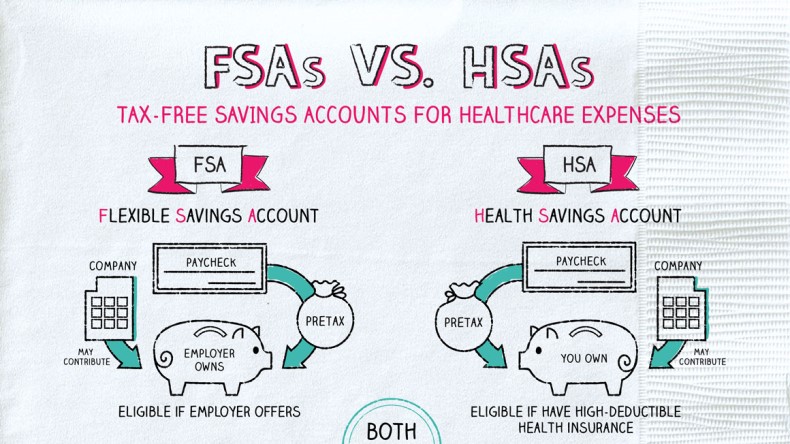

Hsa Vs Fsa Accounts Side By Side Healthcare Comparison The Motley Fool

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

Child And Dependent Care Tax Credit Who Qualifies And How To Get Up To 8 000 Bankrate

Dependent Care Fsa Vs Dependent Care Tax Credit Finstream Tv

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Fsa Vs Hsa Account What Is An Hsa H R Block

What Are Fsas Vs Hsas Napkin Finance

2021 Changes To Dcfsa Cdctc White Coat Investor

2021 Changes To Dcfsa Cdctc White Coat Investor

Everything You Need To Know About Dependent Care Fsas Youtube

Flexible Spending Accounts Bank On A Tax Break Flexible Spending Accounts Bank On A Tax Break Administered By Cbiz Payroll Ppt Download

Lower Income Taxes With Dependent Care Flexible Spending Accounts Ketel Thorstenson Llp

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Child And Dependent Care Tax Credit Vs Dependent Care Fsa 2022 Youtube