property tax assistance program florida

Each state or even each local jurisdiction such as a county will have its own specific form you must fill out to report your personal property tax. Every state has an Unemployment Compensation Program.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-77332455-577f3a8c5f9b5831b5dd010f.jpg)

What Is A Property Tax Circuit Breaker

How is Florida Property Tax.

. Filing personal property tax returns. In 2012 legislation passed in Florida changed the name of Floridas Unemployment Compensation Law to the Reemployment Assistance Program Law. If you believe a local business is not registered with the Department for a specific tax you may call the Departments Taxpayer Assistance at 850-488-6800 Monday-Friday excluding holidays to obtain information about a business registration status.

If you would like to be added to our email list and receive Brownfields Program updates click the button below. Florida sales tax rate is 6. The correction of a Direct Assessment placed on the property from a municipality or special district.

Please contact the local office nearest you. The mission of the program is to reduce the monthly energy. The Brevard County Tax Collectors Office is committed to ensuring website accessibility for people with disabilities.

Florida Corporate Income Tax. Florida Property Tax is based on market value as of January. Property tax exemption for property that is owned and operated by a federally recognized Native American tribe.

Even if the property was gifted to you through an estate or you own a rental property you are still required to pay Florida real property taxes. The program will no longer be available at the end of this school year and many food insecure families are now facing a summer without school food assistance programs. The allowance of an exemption that was previously omitted.

An income-based program for homeowners age 65 and older and those receiving Supplemental Security Income SSI. For questions about filing extensions tax relief and more call. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

Businesses impacted by the pandemic please visit our COVID-19 page. The Weatherization Assistance Program WAP annually provides grant funds to community action agencies local governments Indian tribes and non-profit agencies to provide specific program services for low-income families of FloridaThese entities provide program services throughout the state. Corporations that do business and earn income in Florida must file a corporate income tax return unless they are exempt.

12 Ways to Get Your Retirement Plan Back on Track. The State of Florida manages this. No circuit breaker tax relief.

Florida does not have a state income tax. For more information contact the Brownfields Program Manager at. And open on Fridays from 830 am.

For example in Duval County the jurisdiction requires you to report all property on its tax form and provide the fair market value and cost of each item. The objective of the Federal Emergency Management Agencys FEMA Public Assistance PA Grant Program is to provide assistance to state tribal local governments and certain types of private non-profit organizations so that communities can quickly respond to and recover from major disasters or emergencies declared by the president. The Department registers employers collects the tax and wage reports due assigns tax rates and audits employers.

To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the office at 321 264-6930 or visit the Contact Us page to send an electronic message. Online videos and Live Webinars are available in lieu of in-person classes. Tax Collectors Public Service Office located at 200 NW 2nd Avenue Miami Florida 33128 is open Monday through Thursday from 830 am.

There is no minimum or maximum of real property taxes you could owe in Florida. Whether you have a 10000 or 1000000 house you will owe real property taxes in Florida. A change or correction to the assessed value of the property.

A bill that replaces the Annual Secured Property Tax Bill due to the following reasons. RenewExpress or Tourist Development Tax. Kelly Crain Environmental Manager Florida Department of Environmental Protection Mail Station 4535 2600 Blair Stone Road Tallahassee Florida 32399-2400 850-245-8953.

Or the inclusion of a penalty for. An income-based program for homeowners age 65 and older. The situation is made even more dire as inflation and the cost-of-living soars leaving millions of individuals and families in critical need of year-round nutritional assistance.

For instance she says the deadline for seniors applying for Oregons property tax deferral program was extended from April 15 to June 15 2020.

Home Citrus County Tax Collector

How School Funding S Reliance On Property Taxes Fails Children Npr

How To Know When To Appeal Your Property Tax Assessment Bankrate

Property Tax Orange County Tax Collector

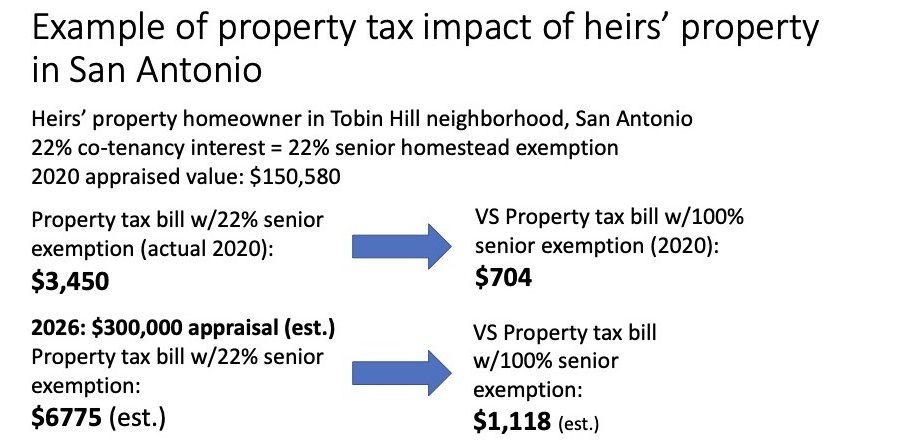

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Six Ways You Can Legally Avoid At Least Part Of Your Florida Property Tax Bill

Exemption Information Polk County Tax Collector

Secured Property Taxes Treasurer Tax Collector

Florida Tax Information H R Block

How Taxes On Property Owned In Another State Work For 2022

Soaring Home Values Mean Higher Property Taxes

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A

Florida Sales Tax J David Tax Law

Florida Property Tax H R Block

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

What Is A Homestead Exemption And How Does It Work Lendingtree